US Dollar moves higher to 93.80, daily highs

The greenback, in terms of the US Dollar Index, seems to have recovered the smile (or part of it) at the beginning of the week, currently hovering over the 93.80/85 band.

US Dollar focus on the FOMC

Despite the current tepid recovery, the index stays depressed and well into the bearish territory after hitting a fresh multi-month low once again in the vicinity of 93.60 during overnight trade.

Long positions in the buck continue to unwind and there still no sight of any recovery in the sentiment in the short term at least. Not unless the political effervescence in the US is dialed down, the Federal Reserve shifts to a more aggressive (hawkish) tone or convinces investors of its (clear?) intentions to start reducing its balance sheet later this year as well as continuing its tightening cycle.

Poor results in the US docket as of late and recent Fedspeak advocating for a more gradual approach when comes to tighten the monetary conditions continue to support the above, playing against any recovery in the demand for the buck.

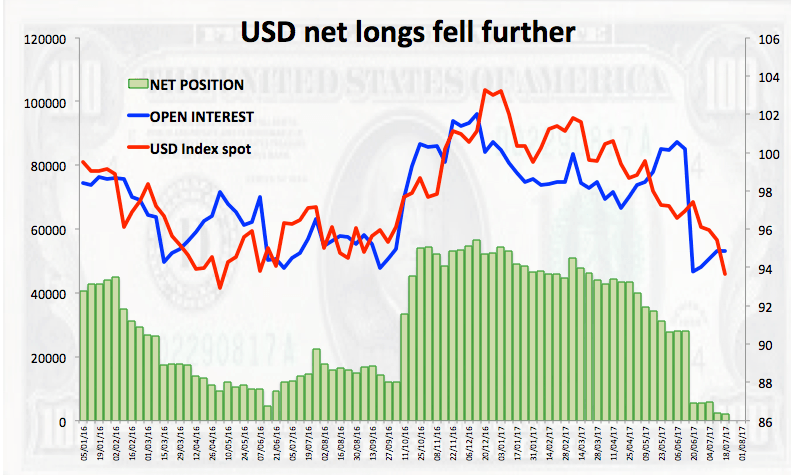

Adding to the worrying scenario, USD speculative net longs remained on the downside during the week ended on July 18, this time retreating to levels last seen in mid-June 2014 according to the latest CFTC report.

In the US data space, July’s advanced manufacturing/services PMI and June’s existing home sales are due next.

US Dollar relevant levels

The index is gaining 0.05% at 93.83 facing the next up barrier at 94.69 (10-day sma) seconded by 94.98 (high Jul.20) and finally 95.32 (21-day sma). On the downside, a break below 93.65 (2017 low Jul.24) would open the door to 93.41 (low Jun.8 2016) and finally 93.03 (low Jun.23 2016).