Crude oil WTI supported at $70.50 after two days in the red

- Crude finds support at $70.52 a barrel after losing more than $2 in the last two days.

- Oil has been easing from its 2018 top as OPEC says it intends to raise production to compensate the potential loss from Venezuela and Iranian output.

Crude oil slides for the third day in a row and finds support at $70.52 a barrel. Indeed, oil has retreated from its 2018 high at 72.83 on talks that OPEC could raise its oil production to compensate the potential loss from Venezuela and Iranian output.

Venezuela is in the midst of a deep crisis and its oil output is at a 70-year low while impending sanctions on Iran can materialize in a supply squeeze of up to 500,000 barrels per day, according to analysts.

Meanwhile, it has been reported that the International Maritime Organization (IMO) will enforce new emissions standards in order to reduce the pollution from ships. It is set to enter into effect on January 1, 2020, and according to analysts, this can be another major driver for oil prices over the next two years as the energy and shipping industries are not quite ready for the incoming change.

More specifically, the IMO is looking to cut sulfur emissions which are found in acid rain which damage wildlife, vegetation and is also responsible for respiratory illnesses.

Looking further investors will pay attention to the weekly rig count on Friday at 17:00 GMT which can provide short-term trading opportunities but is highly unlikely to provide any long-term directional clues.

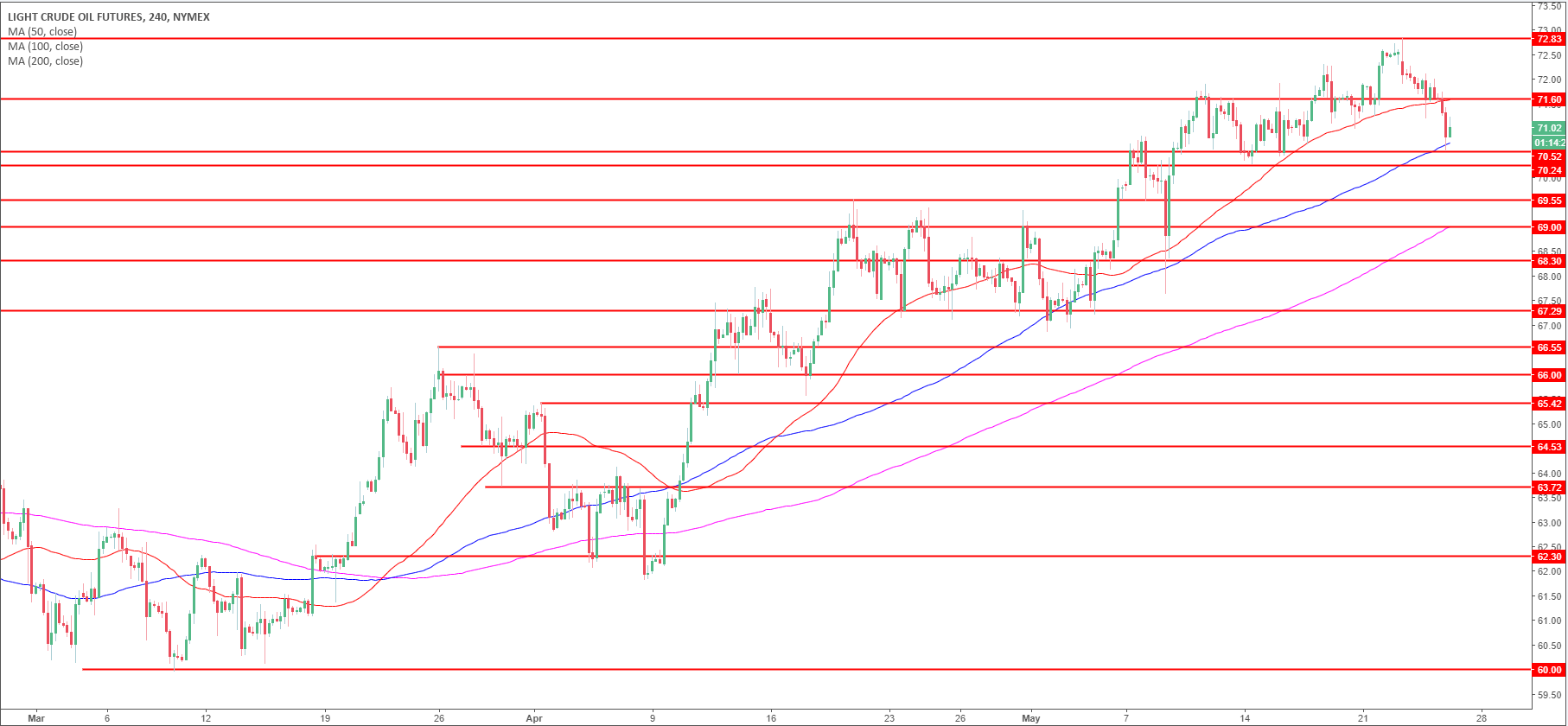

WTI crude oil 4-hour chart

Oil is trading above its 100 and 200-period simple moving averages (SMA) on the 4-hour time-frame while it is trading below the 50-period SMA. Although black gold fell for the last two days, the trend remains strong and the market is back into familiar ranges. Bulls will try to keep the market above the 70.24 swing low and if they fail the next support is seen at 69.55 swing high. Bulls are also finding support at the 100-period SMA and will try to drive the market back to the 71.60 resistance and possibly to the 72.83 level which is the high of 2018.