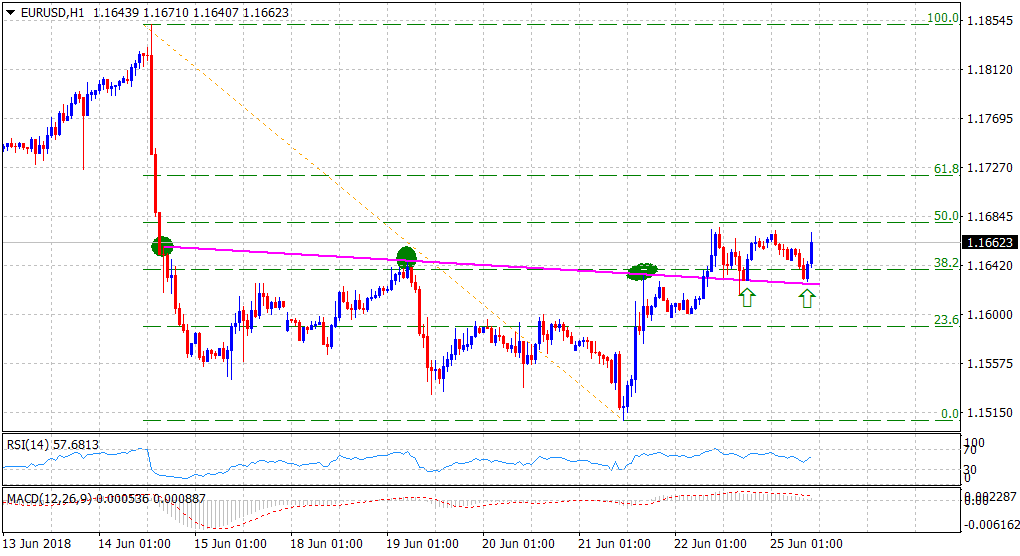

EUR/USD Technical Analysis: survives a test of resistance turned support

• Manages to reverse early dip despite a modest USD uptick, with traders even shrugging off not too encouraging German business climate survey result.

• A sustained move above 1.1675-80 immediate hurdle (50% Fibonacci retracement level of the post-ECB slide) would add credence to the formation of a double-bottom bullish reversal chart pattern on the daily chart.

• Weakness below the resistance turned support, leading to a subsequent break below the 1.1600 handle might negate prospects of any further recovery.

EUR/USD 1-hourly chart

Spot Rate: 1.1662

Daily Low: 1.1629

Daily High: 1.1673

Trend: Bullish until holds above 1.1600 mark

Resistance

R1: 1.1675 (Friday's swing high)

R2: 1.1700 (round figure mark)

R3: 1.1720 (R2 daily pivot-point)

Support

S1: 1.1625 (resistance break-point)

S2: 1.1599 (100-period SMA H1)

S3: 1.1567 (S2 daily pivot-point)