US Dollar Index Technical Analysis: Greenback bulls to target 96.00 figure in the short-term

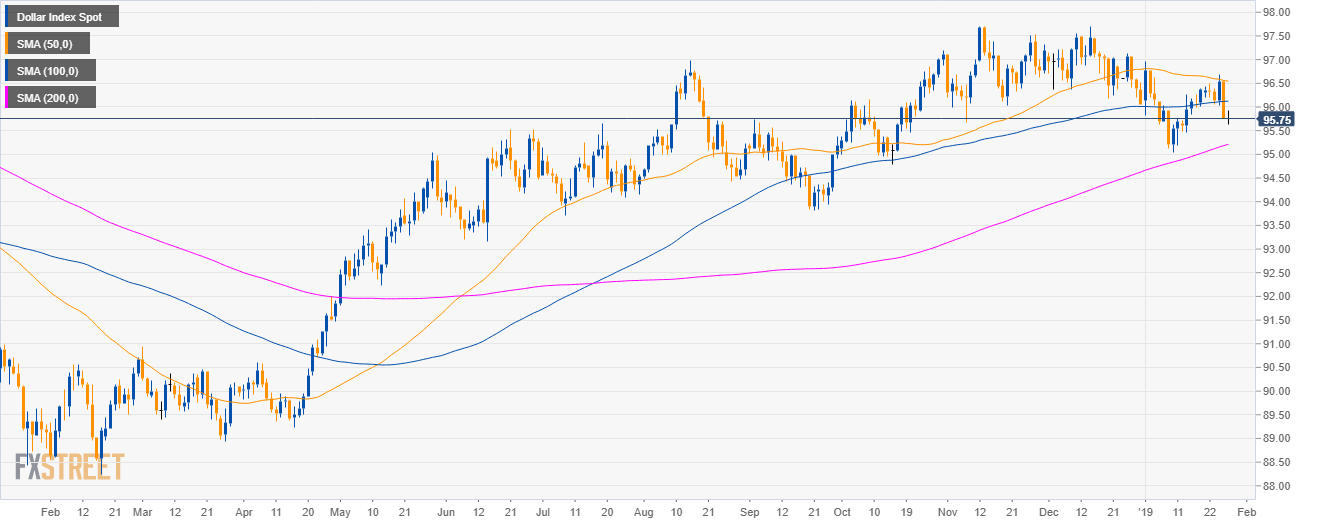

DXY daily chart

- The US Dollar Index (DXY) is in a bull trend above 200-day simple moving average (SMA).

- However, bears are trading below the 50 and 100 SMAs.

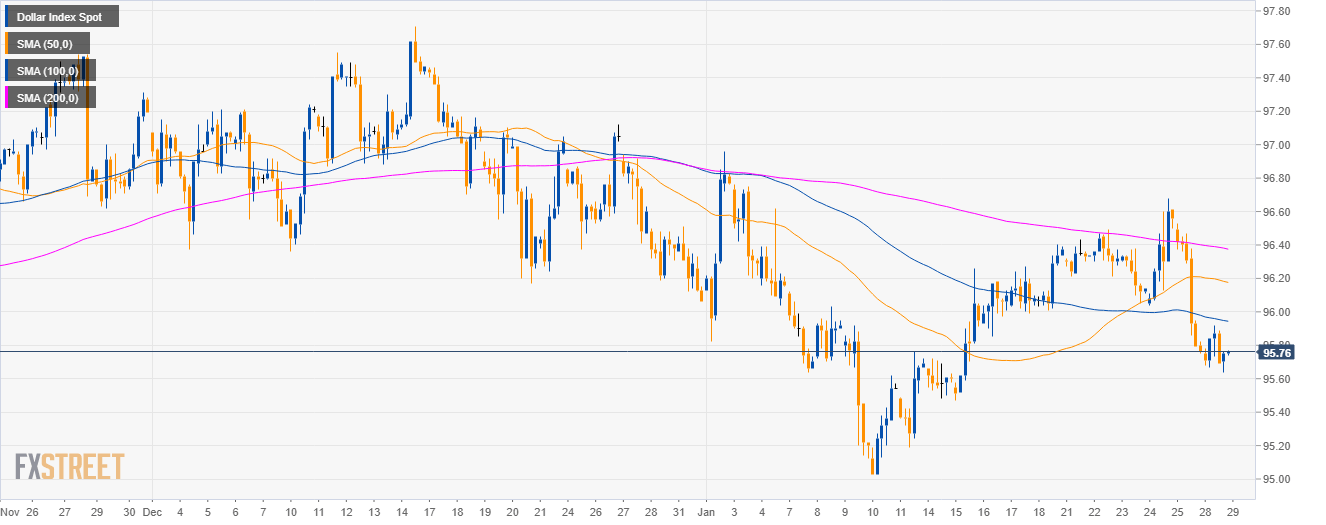

DXY 4-hour chart

- DXY is trading below the main SMAs, suggesting bearish momentum in the medium-term.

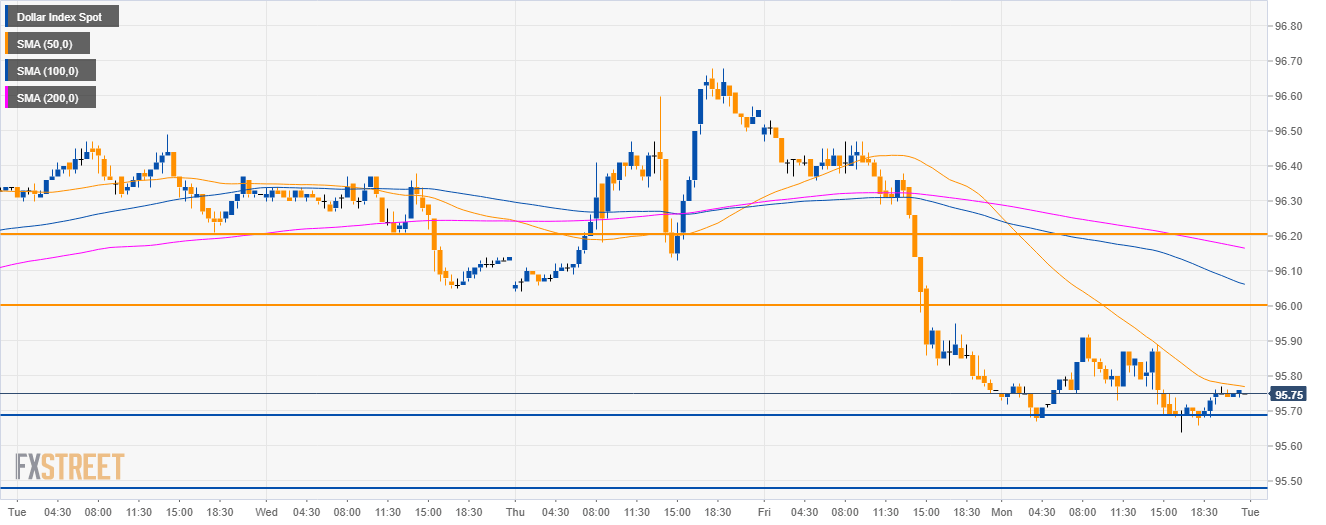

DXY 30-minute chart

- DXY found some support at 95.70 suggesting a potential short-term rebound to 96.00 and 96.20 if the bulls gather enough steam.

- The next level of support to the downside is seen at 95.50.

Additional key level

Dollar Index Spot

Overview:

Today Last Price: 95.76

Today Daily change: 0.00 pips

Today Daily change %: 0.00%

Today Daily Open: 95.76

Trends:

Daily SMA20: 96.05

Daily SMA50: 96.56

Daily SMA100: 96.12

Daily SMA200: 95.18

Levels:

Previous Daily High: 96.56

Previous Daily Low: 95.75

Previous Weekly High: 96.68

Previous Weekly Low: 95.75

Previous Monthly High: 97.71

Previous Monthly Low: 96.06

Daily Fibonacci 38.2%: 96.06

Daily Fibonacci 61.8%: 96.25

Daily Pivot Point S1: 95.49

Daily Pivot Point S2: 95.21

Daily Pivot Point S3: 94.68

Daily Pivot Point R1: 96.3

Daily Pivot Point R2: 96.83

Daily Pivot Point R3: 97.11