USD/INR Technical Analysis: 100-day MA is key resistance

The USD/INR pair closed at 71.44 on Feb. 1, confirming a bull flag breakout. The 100-day moving average (MA), however, has put the brakes on the post-breakout rally.

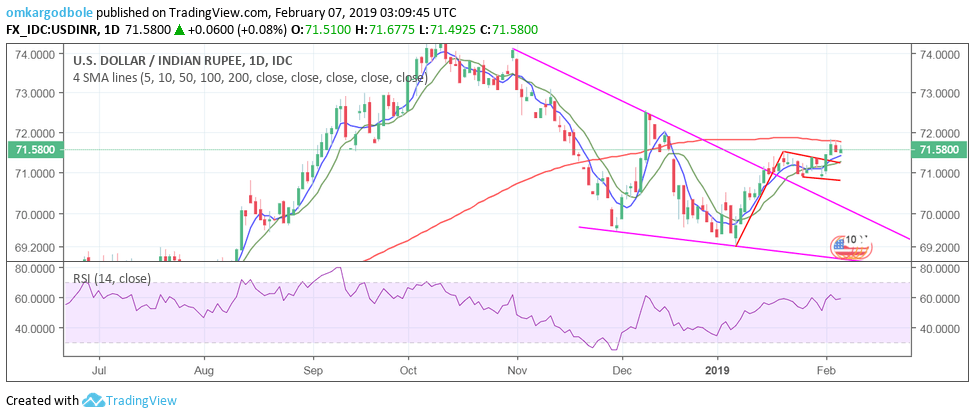

Daily chart

The back-to-back failure to penetrate the 100-day MA on a closing basis is a slight cause for concern. The outlook, however, remains bullish while the pair is held above the former resistance-turned-support of 71.38 (Jan. 29 high).

With 5- and 10-day moving averages (MAs) trending north, dips to 71.38, if any, could be short-lived.

A close above the 100-day MA of 71.78 would bolster the already bullish setup and open up upside toward 72.55. Note that the 14-day RSI is located at 58, meaning there is sufficient room for a convincing move above 72.00.

India' Nifty index has found acceptance above the crucial resistance of 11,000. The stocks, therefore, could remain better bid, providing some support to INR.

Trend: cautiously bullish

USD/INR

Overview:

Today Last Price: 71.675

Today Daily change: 0.0950 pips

Today Daily change %: 0.13%

Today Daily Open: 71.58

Trends:

Daily SMA20: 71.1083

Daily SMA50: 70.7616

Daily SMA100: 71.7746

Daily SMA200: 70.352

Levels:

Previous Daily High: 71.78

Previous Daily Low: 71.475

Previous Weekly High: 71.64

Previous Weekly Low: 70.82

Previous Monthly High: 71.64

Previous Monthly Low: 69.185

Daily Fibonacci 38.2%: 71.6635

Daily Fibonacci 61.8%: 71.5915

Daily Pivot Point S1: 71.4433

Daily Pivot Point S2: 71.3067

Daily Pivot Point S3: 71.1383

Daily Pivot Point R1: 71.7483

Daily Pivot Point R2: 71.9167

Daily Pivot Point R3: 72.0533