Back

11 Mar 2019

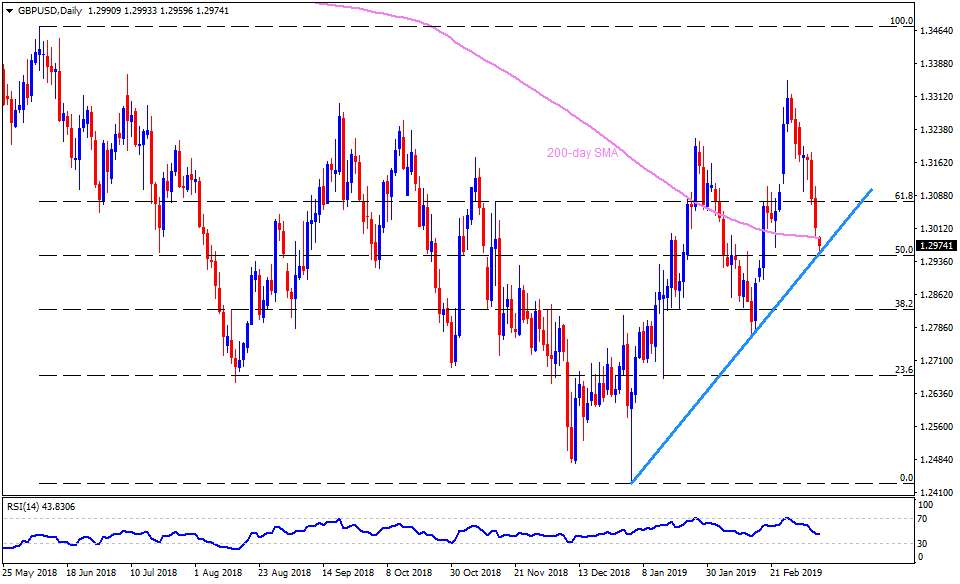

GBP/USD Technical Analysis: Immediate supportline questions bears aiming for 1.2900

- GBP/USD trades little weak around 1.2980 during early Monday.

- The pair slipped beneath 200-day simple moving average (SMA) but couldn’t decline much under immediate ascending support-line joining January low to February ones.

- As a result, 1.2950 – 1.2990 area seems restricting the movement ahead of the London market open.

- Should the quote dips below 1.2950, 1.2900, 38.2% Fibonacci retracement of June 2018–January 2019 slide, at 1.2830 and February low near 1.2770 can gain sellers’ attention.

- In a case prices rally beyond 1.2990 SMA resistance, a break of 1.3000 can work as a validation to additional rise towards 61.8% Fibonacci retracement near 1.3075/80.

- Also, the pair’s successful rise above 1.3080 could favor optimists to target 1.3180.

GBP/USD daily chart

GBP/USD

Overview:

Today Last Price: 1.2977

Today Daily change: -0.0036 pips

Today Daily change %: -0.28%

Today Daily Open: 1.3013

Trends:

Daily SMA20: 1.3059

Daily SMA50: 1.2972

Daily SMA100: 1.2882

Daily SMA200: 1.2987

Levels:

Previous Daily High: 1.3109

Previous Daily Low: 1.299

Previous Weekly High: 1.3269

Previous Weekly Low: 1.299

Previous Monthly High: 1.3351

Previous Monthly Low: 1.2773

Daily Fibonacci 38.2%: 1.3035

Daily Fibonacci 61.8%: 1.3063

Daily Pivot Point S1: 1.2966

Daily Pivot Point S2: 1.2919

Daily Pivot Point S3: 1.2847

Daily Pivot Point R1: 1.3084

Daily Pivot Point R2: 1.3156

Daily Pivot Point R3: 1.3203