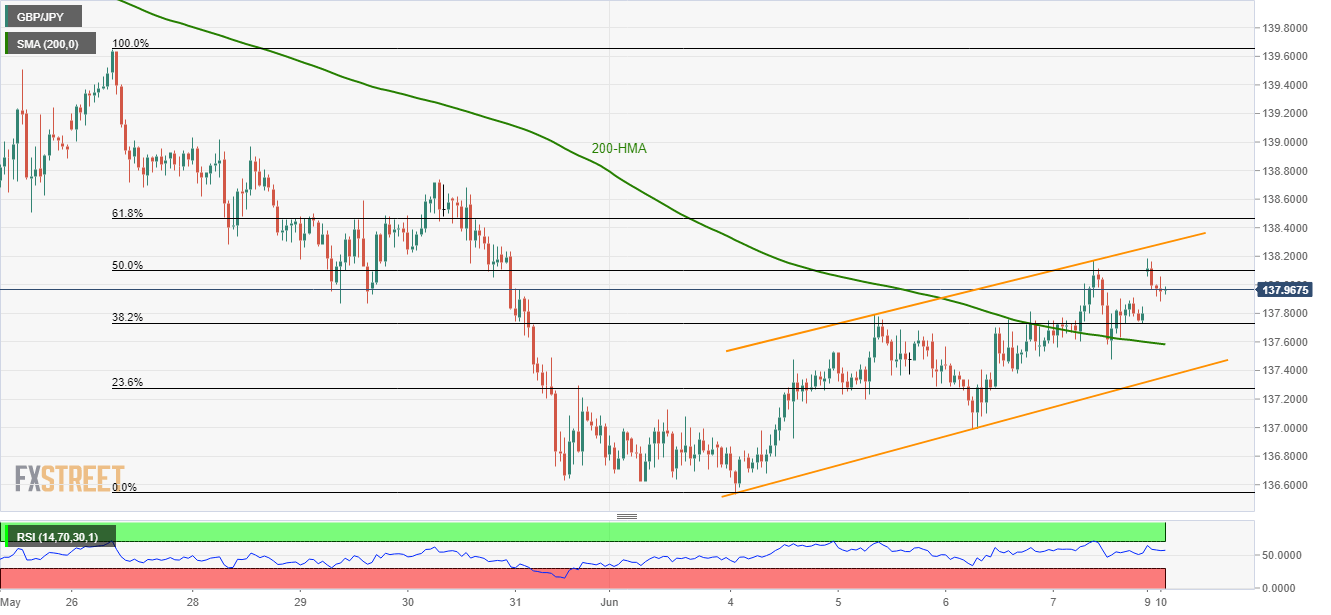

GBP/JPY technical analysis: Immediate rising channel favor buyers despite pullback towards 200-HMA

- The pulls back from near-term bullish pattern’s resistance.

- 200-HMA may offer immediate support.

GBP/JPY’s latest pullback still falls short of challenging a week-old trend rising trend channel as the pair seesaws near 137.95 during early Monday.

Profit-booking from the pattern resistance gives rise to expectations of the quote’s further declines towards another important support, near 200-hour moving average (HMA), near 137.60, ahead of highlighting the formation support of 137.36.

Should sellers defy bullish formation, 137.00 and current month low near 136.54 might flash on their radars to target.

Meanwhile, formation resistance around 138.30 may keep limiting near-term upside, a break of which can escalate the rise in the direction to May 30 high of 138.75.

Given the pair’s successful north-run past-138.75, 139.00, 139.65 and 140.00 may gain market attention.

GBP/JPY hourly chart

Trend: Bullish