Back

18 Jul 2019

GBP/USD technical analysis: 1.2432/28 becomes the tough nut to crack for sellers

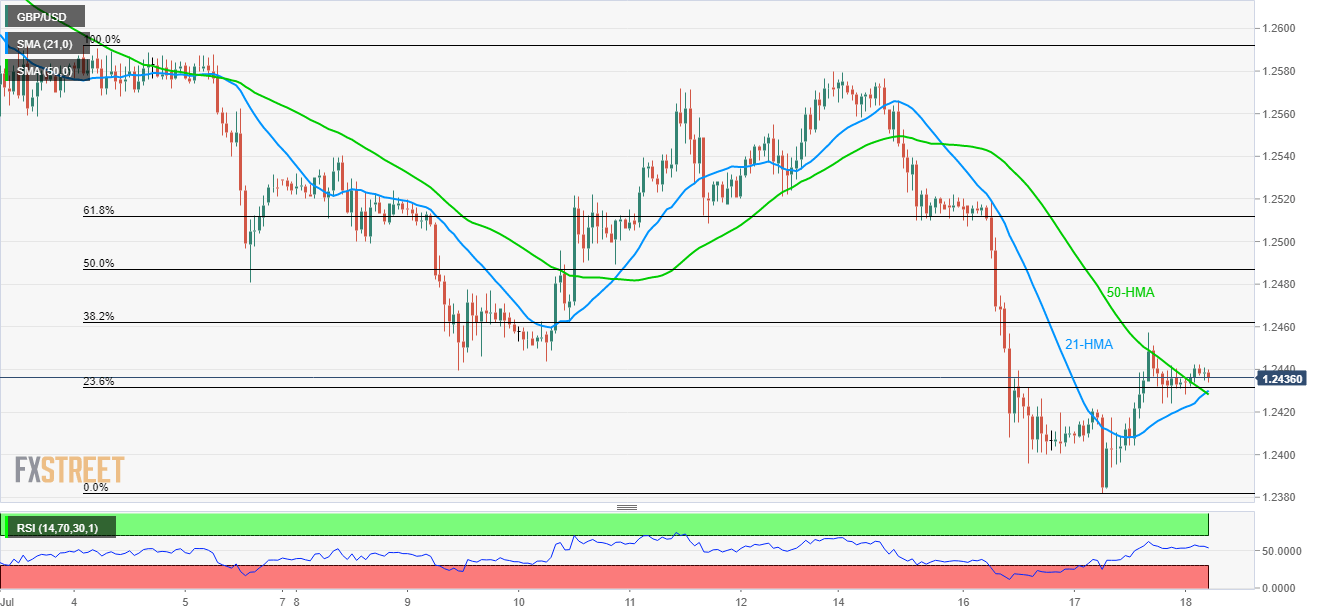

- 21 and 50 hourly moving averages (HMAs), coupled with 23.6% Fibonacci retracement, limit the GBP/USD pair’s near-term declines.

- Buyers wait for a sustained run-up beyond 1.2462.

With the key short-term moving averages and Fibonacci retracement levels limiting the downside, GBP/USD takes the rounds to 1.2438 heading into the UK open on Thursday.

While strong supports limit the quote’s declines, buyers await a successful rise beyond 38.2% Fibonacci retracement of 2-week old trade moves, at 1.2462, in order to register fresh upside towards 50% and 61.8% Fibonacci retracement levels, 1.2488 and 1.2512 respectively.

It should also be noted that the pair’s rise past-1.2512 might not refrain from questioning mid-month high around 1.2580.

In a case prices slip beneath 1.2432/28 support-confluence, 1.2400 and recent low surrounding 1.2380 may entertain sellers targeting 1.2300 round-figure.

GBP/USD hourly chart

Trend: Sideways