USD/JPY Price Analysis: Recedes from monthly resistance line towards 107.00

- USD/JPY defies the previous day’s pause to three-day losing streak.

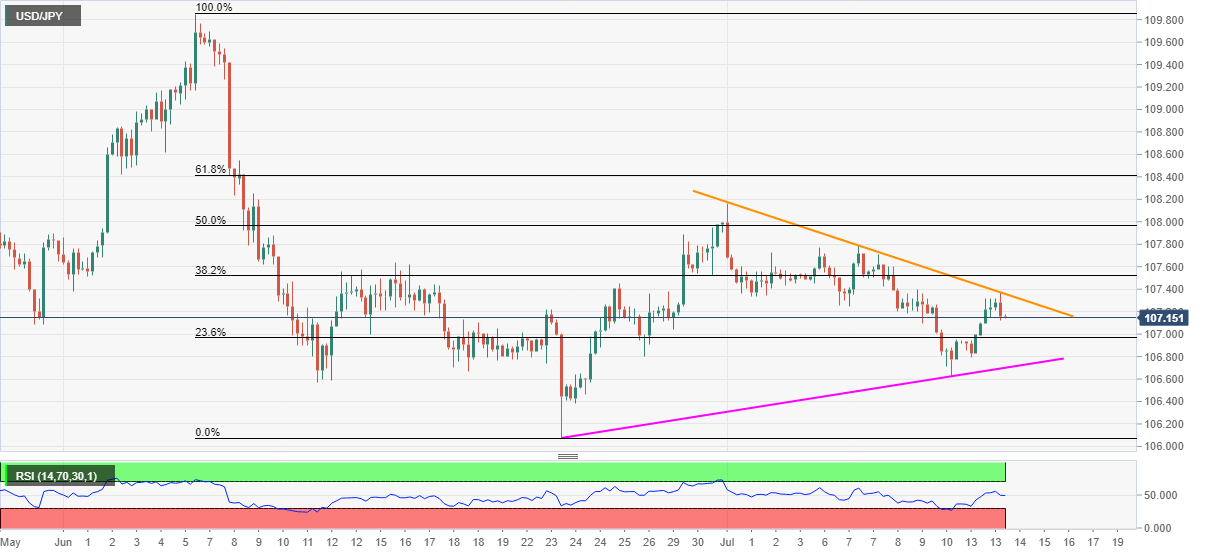

- An upward sloping trend line from June 23 lures the bears.

- Bulls can aim for 108.00 beyond the said trend line.

USD/JPY drops to 107.16, down 0.12% on a day, while heading into the European open on Tuesday. The pair recently reversed from a two-week-old falling trend line. In doing so, the quote defies Monday’s gains, the biggest in the month.

Considering the normal conditions of RSI, coupled with the strength of the short-term resistance line, the sellers seem to target 107.00 ahead of eyeing a visit to a three-week-long rising support line, at 106.70.

Although trading momentum is likely to respect the said support below 107.00, any further downside could recall the late-June bottom around 106.08.

Alternatively, the pair’s successful break above the immediate resistance line, at 107.35 now, enables the buyers to challenge 107.80 before aiming 50% Fibonacci retracement level of 108.00.

Further, the pair’s extended rise past-108.00 can linger unless crossing 61.8% Fibonacci retracement level of 108.40.

USD/JPY four-hour chart

Trend: Further weakness expected