WTI bulls keep prices supported above $50 mark after bullish inventory numbers

- Bullish official EIA inventory numbers are helping WTI bulls keep prices above the $50 mark.

- The prospect of much more fiscal stimulus in 2020 under a Democrat-controlled Congress and voluntary Saudi output cuts are also helping.

The front-month futures contract for the American benchmark for light sweet crude oil (WTI) has survived a brief pre-US session dip below the $50 level and has recently recovered back above the $50.50 level to set fresh highs since February 2020. At present, WTI trades with gains of around 1.4% or 70 cents.

The recent push back to the north of the $50 level was spurred by bullish weekly EIA crude oil inventory numbers; headline crude oil stocks saw a much larger than expected draw of over 8M barrels (implying much stronger than expected demand for crude oil in the US last week). Much larger than expected builds in gasoline and distillate stocks were shrugged off.

OPEC+ and the Saudis

As a recap; WTI was boosted above the $50 level for the first time since February 2020 after the Saudi Arabians announced at the end of Tuesday’s OPEC+ meeting that they would be voluntarily cutting oil production by 1M barrels per day in February and March. The cut more than makes up for OPEC+ allowance for Russia and Kazakhstan to increase output by a combined 75K barrels per day in order to meet higher seasonal domestic demand. Some have argued that crude oil upside is being capped by the bearish signal that Saudi eagerness towards voluntary cuts sends about potential worse than expected weakness in crude oil demand in the months ahead.

Fiscal stimulus to boost US growth & fuel demand

The Democrats pulled off an upset in Tuesday’s Senate elections in Georgia, winning both of the available seats and handing the party a majority in both branches of Congress. That means the Democrats and Biden administration have a much greater chance of implementing their economic agenda.

As far as crude oil markets are concerned, this agenda that control over Congress unlocks ought to be bullish; significant further government spending on fiscal stimulus, be that on direct payments to citizens or investment in infrastructure, will boost US fuel demand in 2021 and beyond. Moreover, tougher regulations on the US energy sector might restrict US output, another potentially bullish crude oil factor.

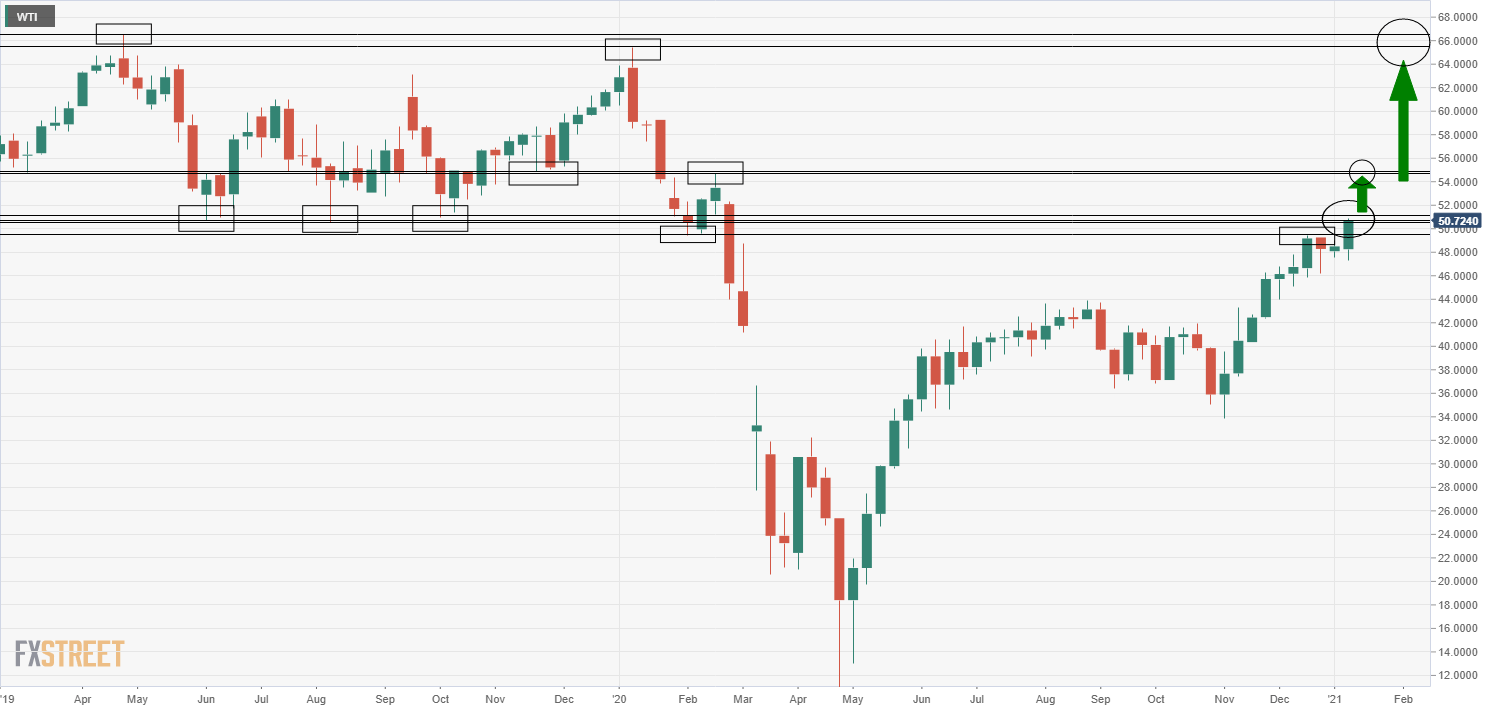

Crude oil at key resistance area

$50.50-$51.00 was a key area of support for front-month WTI crude oil futures throughout most of 2019. A break above this area, technically speaking, puts WTI back in the $50.50-$65.00ish range that prevailed for most of 2019. If the bullish momentum does continue, the mid-February highs at just under $55.00 will be the next key area to look at. Above that, the door is open to a rally all the way back to the early 2020 highs (set in wake of the US/Iran war scare) of just above $65.00.

WTI weekly chart