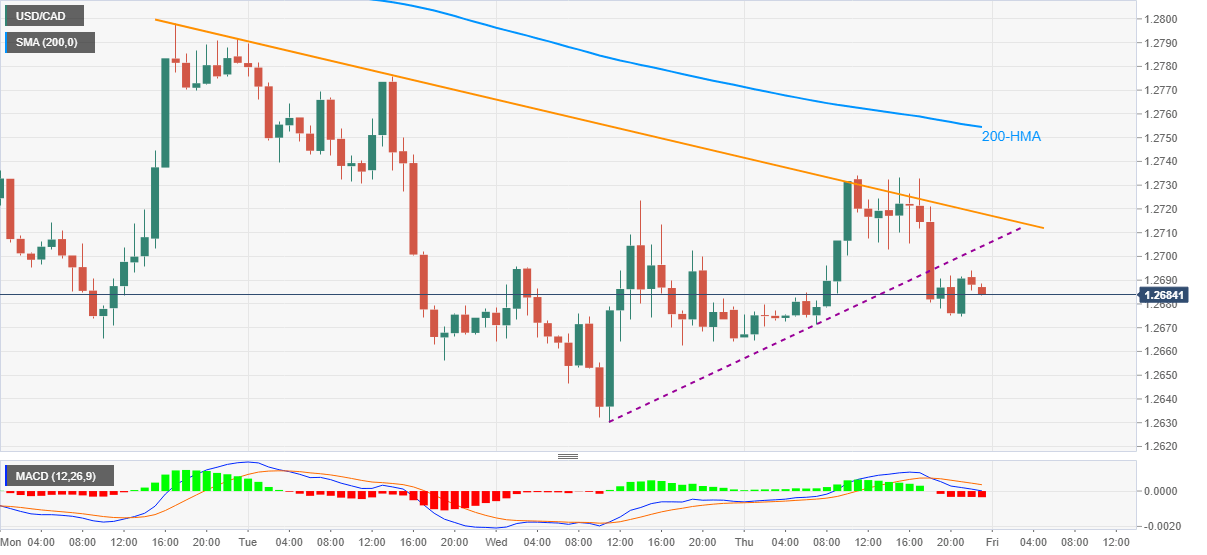

USD/CAD Price Analysis: Depressed below 1.2700, keeps break of immediate support line

- USD/CAD fails to keep recovery moves from 1.2630.

- Bearish MACD, sustained break of immediate support line, now resistance, favor sellers.

- Bulls will have 200-HMA as additional hurdle to the north.

USD/CAD keeps downside break of an ascending support line from Wednesday while easing to 1.2685 amid Friday’s Asian session. That said, bearish MACD and a weekly resistance line add to the strength of the downside momentum.

The quote currently eyes 1.2675 and 1.2660 immediate supports ahead of challenging the weekly low, also the lowest since April 2018, of 1.2630.

During the quote USD/CAD downturn past-1.2630, the 1.2600 round-figure may offer an intermediate halt ahead of direct the bears towards the April 2018 bottom near 1.2525.

On the contrary, an upside break of the previous support, at 1.2700 will have to cross the weekly resistance line, near 1.2720, to eye the 200-HMA level of 1.2754.

Though, any upside past-200-HMA will be enough for the USD/CAD buyers’ entries. Following that, the late December high of 1.2957 could return to the chart.

USD/CAD hourly chart

Trend: Bearish