US Dollar Index regains the upside and test 91.70, look to yields, data

- DXY reverses the recent weakness and approach 92.00.

- US yields regain traction and trade closer to 1.60%.

- US Producer Prices, advanced U-Mich index next on tap.

The greenback regains the smile and pushes the US Dollar Index (DXY) back to the vicinity of the 92.00 mark at the end of the week.

US Dollar Index up on yields recovery, looks to data

The index advances moderately on Friday and reverses three consecutive daily pullbacks on the back of the rebound in US yields, with the 10-year note approaching once again the key 1.60% area.

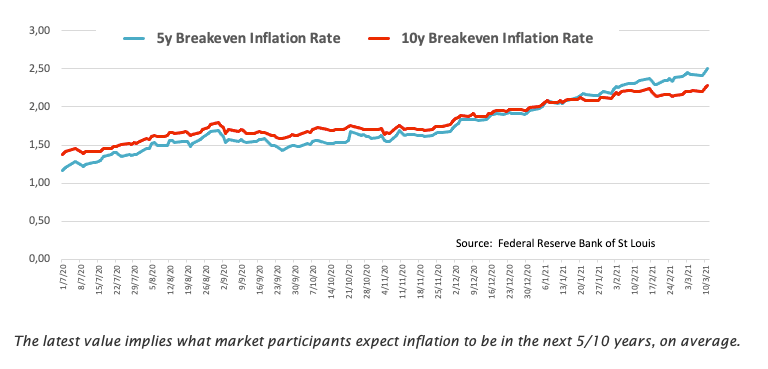

The recovery in US yields comes after discouraging US inflation figures for the month of February cool down expectations of higher inflation in the next months, which in turn remain sustained by the planned increase in fiscal spending. On the latter, the $1.9 trillion stimulus package became law after President Biden signed it on Thursday.

Later in the US data space, February’s Producer Prices are due seconded by the advanced gauge of the Consumer Sentiment.

What to look for around USD

Disappointing inflation figures released earlier in the week dented the upside sentiment surrounding the dollar, sparking a corrective downside that met support near 91.30 for the time being. The change of heart in the buck seen in past weeks came in tandem with the strong bounce in US yields to levels recorded over a year ago, all against the backdrop of rising investors’ perception of higher inflation in the next months. However, a sustainable move higher in DXY should be taken with a pinch of salt amidst the mega-accommodative stance from the Fed (until “substantial further progress” is seen), extra fiscal stimulus and hopes of a strong economic recovery overseas.

Key events in the US this week: February’s Producer Prices, Advanced Consumer Sentiment (Friday).

Eminent issues on the back boiler: US-China trade conflict under the Biden’s administration. Tapering speculation vs. economic recovery. US real interest rates vs. Europe. Could US fiscal stimulus lead to overheating? Future of the Republican party post-Trump acquittal.

US Dollar Index relevant levels

At the moment, the index is gaining 0.34% at 91.73 and a breakout of 92.50 (2021 high Mar.9) would expose 92.80 (200-day SMA) and finally 94.30 (monthly high Nov.4). On the other hand, the next support emerges at 91.36 (weekly low Mar.11) seconded by 91.05 (high Feb.17) and then 90.66 (50-day SMA).