Gold Price Forecast: Fed statement leaves price steady in familiar range

- Gold prices are steady at critical daily support post-Fed statement.

- A benign statement has left markets at a standstill, awaiting Fed's chair presser.

The two-day Federal Open Market Committee meeting has drawn to a close this afternoon and the statement has been released.

This event was widely seen as a placeholder meeting by the Fed and the market's expectation was for a modestly hawkish hold which is what the statement has offered.

There were expectations of the acknowledgements of inflation risks, risks of the delta variant and discussions of tapering which is what we have from the statement.

Markets are now hinging on the words of the Fed's chair, Jerome Powell in the Press conference.

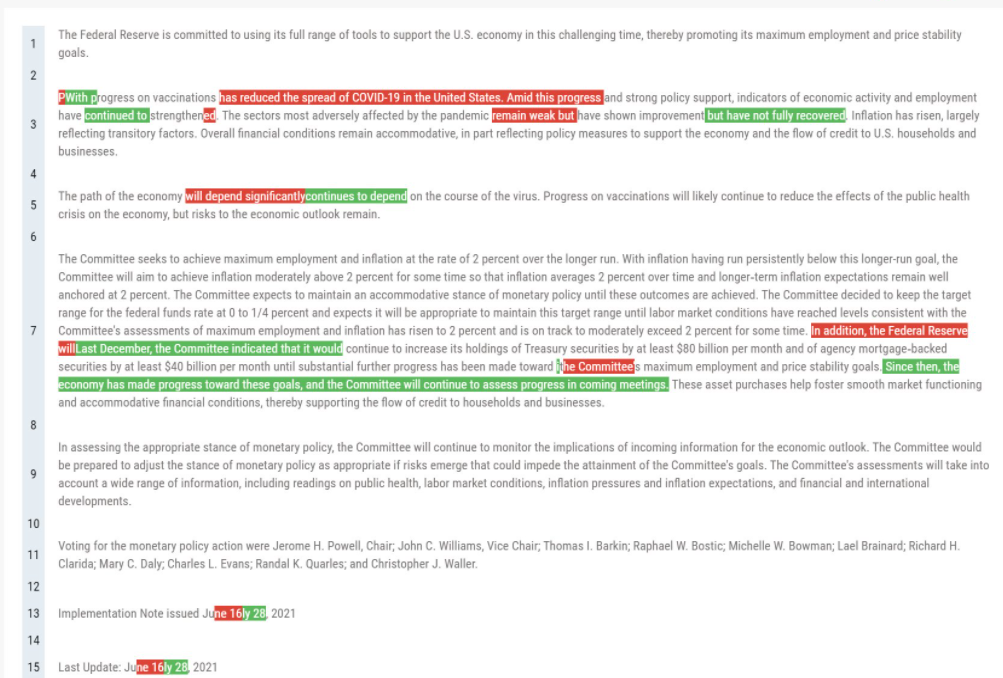

FOMC Statement comparison

The changes that do stand out in the statement are as follows:

1. The FOMC removed this entire line: "Progress on vaccinations has reduced the spread of COVID-19 in the United States".

2. An addition, "Not fully recovered".

3. The Fed "made progress" towards taper goals.

The price of gold is being pressured as the US dollar rallies to test daily and 4-hour resistances.

Gold 15-min chart

A drop and pop back to the start again.

Fed statement, key takeaways

- Benchmark interest rate unchanged; target range stands at 0.00% - 0.25% .

- The interest rate on excess reserves is unchanged at 0.15%.

- Fed announces the launch of the standing repo facility.

- Fed says vaccination progress likely to continue to reduce effects of public health crisis on economy, but risks to the economic outlook remain.

Watch Powell Presser Live

Gold & US dollar technical analysis

Prior to the event, the US dollar was looking into the abyss at trendline support as follows:

The 4-hour structure shows that the price has been reinforced to the downside by two levels of resistance structure.

The most key was the higher level of resistance as this was the apex of the correction that met daily lows and the neckline of the M-formation as follows:

Live market, post-Fed statement

15-min chart

Pop and a drop, back to the start again.

4-hour chart

Meanwhile, for gold, the weekly chart was compelling and a prospect for a downside extension has been building over a number of weeks as follows:

Gold weekly chart

Daily chart support

However, the daily support has been a firm roadblock for the bears into the Fed event and we see little movement so far.